Prepaid funeral contract permit holders are regulated by the Texas Department of Banking (Department) in accordance with Section 154 of the Texas Finance Code and Title 7, Sections 25.10 and 25.11 of the Texas Administrative Code. In addition to the Department, two other state agencies are involved in some facet of the regulation of the funeral industry. The Texas Department of Insurance supervises and regulates insurance companies that offer insurance products used to fund prepaid funeral contracts. Additionally, the Texas Funeral Service Commission licenses and/or regulates funeral homes, funeral directors, and crematories and registers cemeteries. Concerns or complaints concerning prepaid funeral contracts should be directed to the Department while those concerning the underlying insurance funding policy should be addressed to Texas Department of Insurance. Further, complaints pertaining to a funeral director or a funeral establishment should be directed to the Texas Funeral Services Commission. However, the three regulatory agencies share information and forward misdirected complaints to the regulatory agency charged with the statutory authority to obtain resolution.

FAQs

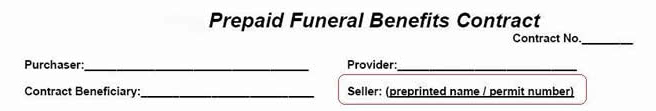

All prepaid funeral contract sellers in Texas are required to hold a permit issued by the Department. Therefore, any funeral establishment that sells prepaid funeral contracts must either have a permit or sell through a licensed third-party permit. The seller's preprinted name and permit number should always be included at the top of page 1 of the prepaid funeral contract. A prepaid funeral contract should look similar to the model contracts. To inquire about a permitted seller, you can visit the Permit Holder Listing link on this website or contact the Department at 1-877-276-5554.

Do not enter into a prepaid funeral contract that has spaces to insert the deceased name or date of service as you could be dealing with an unlicensed seller. Further, please report any suspicious activity such as this in writing to the Department together with copies of any contracts or other information provided by the seller.

The two options available to fund a prepaid funeral contract are trust-funded and insurance-funded. A seller may offer one or both funding types. There are differences between these types including funding mechanisms, federal tax treatment, cancellation benefits, and added costs for finance charges or whole life benefits. See the "Information About Prepaid Funeral Planning" Brochure for more information on funding options.

If the contract beneficiary dies a significant distance from where the contracted funeral provider is located, then the family will need to pay the cost of transportation of the deceased back to the funeral home. The family can choose a local funeral home in the area where the deceased is located; however, that funeral home is under no legal or binding obligation to honor the original prepaid funeral contract prices. In these situations, it is recommended that the family immediately contact the original contract funeral provider for guidance. If the family decides to pay the additional cost of transportation of the deceased back to the selling funeral provider, then the selling funeral home is bound to honor the prepaid contract for the specified prices set forth in the contract, plus any unfunded cash advance items selected by the family.

Yes, each funeral home in Texas can set its own pricing for funeral goods and services. There is no regulation on the pricing of funeral goods and services. The funeral home's General Price List, Casket Price List, and Outer-Burial Container Price List are all available to consumers upon either verbal or written request to a funeral home.

No, contract purchasers cannot modify selected goods and services once a prepaid funeral contract has been executed. The prepaid statutes are clear that there can be no downgrades or partial cancellations of prepaid funeral contracts. If the purchaser wishes to change some previously selected goods or services, the original contract must be canceled and a new contract entered into. Consumers should contact their funeral director to determine the cancellation benefit available under the original contract and what prices will be charged on the new revised contract.

Yes, the contract can be canceled by giving written notice to the seller. The seller will then send you the required cancellation forms which must be completed and returned to the seller. The seller has 30 days from receipt of the completed forms to refund the cancellation benefit. If the contract canceled is an insurance-funded contract, the cancellation benefit will be the cash surrender value of the policy. If the contract canceled is a trust-funded contract, the cancellation benefit in most cases will be the amount paid in less 10% of the total face value. Additionally, purchasers of contracts sold after September 1, 2001 are entitled to receive 50% of the net accrued earnings upon cancellation provided the purchaser has complied with the terms of the contract and the contract was outstanding in excess of one year. A purchaser cancelling a prepaid funeral contract sold before September 1, 2001 is not entitled to any accrued earnings. Lastly, if the seller requests you to cancel the trust funded contract, you are entitled to all funds paid in plus 100% of the accrued earnings in accordance with Section 154.155 of the Texas Finance Code.

If you purchase a trust-funded prepaid funeral contract, you make payments to the permit holder who must deposit your money in a Department-approved financial institution within 30 days of receipt. However the permit holder is allowed to keep 50% of each payment you make up to 10% of the total contract price for its selling and administrative expenses. Your prepaid funeral contract payments are deposited into an interest bearing restricted bank account or formal trust account to pay for the future costs of the selected goods and services.

Upon the death of the beneficiary, if the trust-funded prepaid funeral contract is fully paid, the provider must deliver the guaranteed funeral goods and services at no additional cost.

If payments are current, and you pay any remaining balance due on the contract before the funeral service, the provider must deliver the guaranteed funeral goods and services.

If you purchase an insurance-funded prepaid funeral contract, the prepaid funeral contract beneficiary must apply for insurance coverage. The insurance company will either issue your insurance policy or deny insurance coverage within 30 days after you sign the prepaid funeral contract. If coverage is denied, you will receive a 100% refund from the insurance company.

Upon the death of the beneficiary, the amount paid to the provider depends on what type of policy was issued to fund the prepaid funeral contract and whether premium payments are current. Insurance companies generally have several different types of insurance products that are used in the prepaid funeral contract market; therefore, it is important to read the policy carefully. In annuity contracts and full benefit insurance policies, policy beneficiaries are generally entitled to the full death benefit upon the death of the insured while death benefits are reduced if death occurs during the first few years of the policy for limited benefit insurance as stipulated by the policy terms.

Annuity contract and Full Benefit insurance policies

- The provider must deliver the guaranteed services and merchandise selected at no additional cost if:

- the premiums are current; and

- the remaining balance due on the annuity contract is paid prior to the funeral service

Limited Benefit insurance policy

- The provider must deliver the guaranteed services and merchandise selected at no additional cost if the premiums are current, and:

- the limited death benefit period has expired; or

- the limited death benefit period has NOT expired but the remaining balance due on the insurance policy is paid prior to the funeral service

For both Insurance-Funded and Trust-Funded prepaid funeral contracts

- The provider is not required to deliver the guaranteed services and merchandise selected if:

- the insurance policy funding the prepaid funeral contract is in default; or

- the purchaser did not follow the payment terms in a trust-funded prepaid funeral contract

Trust-Funded: You or your estate may incur a tax liability for interest earned on deposits made under the prepaid funeral contract, however; these earnings are never paid to you. See Internal Revenue Ruling (“IRS”) 87-127 and IRS Code Section 685.

Insurance-Funded: You or your estate may incur a tax liability for the insurance policy benefits if they are paid directly to you.

Yes, you can. The retail casket store must sell and deliver the casket to you, or the funeral home, if it is for immediate need, within 72 hours of purchase. Retail casket stores may not store or promise to deliver caskets beyond 72 hours of purchase unless they hold a permit with the Department and you enter into a prepaid funeral contract.

Texas Administrative Code Section 25.9 defines “package sale” as a grouping of multiple funeral goods and services which is offered to the purchaser at a single price. Although funeral homes may offer a discount for selecting a package service, funeral homes will not be required to provide a refund or a credit for any unused package sale goods or services at the time of need.